Rental property depreciation spreadsheet

This raises the Other Costs in that year to show the client how much they would be paying to sell selling costs pay back depreciation capital gains etc. Now to calculate the rental propertys ROI follow the previous cap rate formula and divide the annual return 7600 by the total investment you initially made 110000.

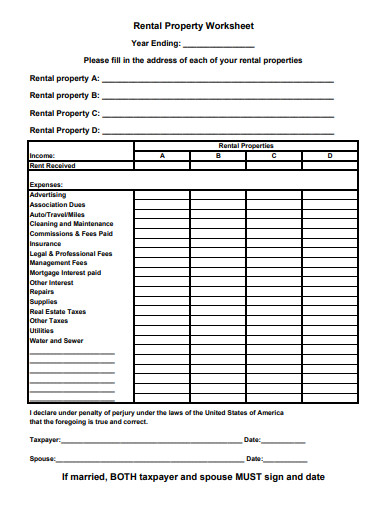

18 Rental Property Worksheet Templates In Pdf Free Premium Templates

An asset account with a credit balance.

. Thus the Other. Expenses That Can be Added to the Cost Base. For accounting and tax purposes the depreciation expense is calculated and used to write-off the cost of purchasing high-value assets over time.

Estimate Rental Income and Expenses. Investing in rental property can be an appealing alternative to owning traditional stocks which can be volatile. Pricing Videos LEARN.

That way you can compare the values and create a value range of low middle and maximum value. If you rent real estate such as buildings rooms or apartments you normally report your rental income and expenses on Form 1040 or 1040-SR Schedule E Part I. Capital improvements repairs to calculate your total cost basis for depreciation.

It should ease you on getting the values to be put on respective journals and reports. Rental property can generate recurring revenue appreciate over time and provide tax benefits. Top Six Property Negotiation Tips For Home Buyers.

Rate of Return on a Rental Property Calculation. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2700000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2022. Stationery telephone expenses and postage.

List your total income expenses and depreciation for each rental property on the appropriate line of Schedule E. Total cost basis used to calculate depreciation 4. It also explains how you can elect to take a section 179 deduction in-stead of depreciation deductions for certain property and.

Alternative Real Estate Investments. I havent been assuming a discount on the market price but If I use the market price Im getting deep negatives in the cash flow calculator. Title Costs such as the legal fees incurred when.

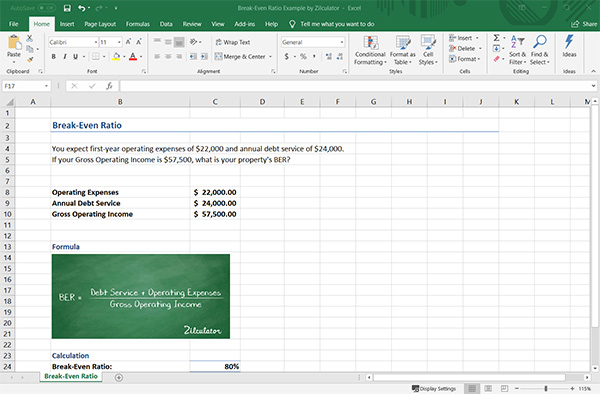

Taxes rental property investors need to pay. The expenses that investors can add to a cost base include but are not limited to. It is a quick and easy way to measure whether a property is worth.

How to Use this Spreadsheet Step 1. It is a fairly basic worksheet for doing a rental property valuation including calculation of net operating income capitalization rate cash flow and cash on cash return. This spreadsheet template pulls data from your initial costs spreadsheet for Year 1 and allows you to add data for consecutive years of your initiative.

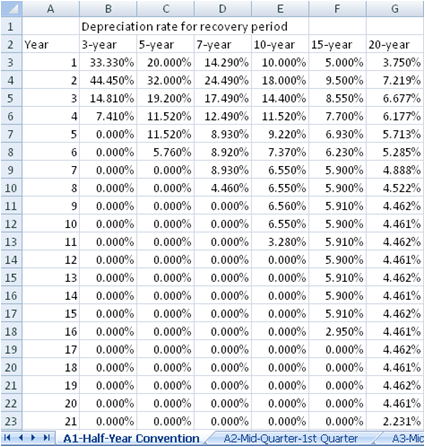

Property depreciation is based on the idea that rental property value is reduced over time due to wear and tear and obsolescence. If you did not when you sell your rental home the IRS requires that you recapture all allowable depreciation to be taxed ie. Business or income-producing property through deduc-tions for depreciation for example the special deprecia-tion allowance and deductions under the Modified Accel-erated Cost Recovery System MACRS.

Get 247 customer support help when you place a homework help service order with us. Depreciation schedule only needs to be provided once. Incidental Costs such as your rental advertisement fees legal fees and stamp duty.

I dont know how you get such good deals in your Build a Rental Property Empire but the houses I find in my area have a rent to price ratio of about 06 which is making this very hard. Estimate fair market value. There are a number of methods for estimating the fair market value of a rental property.

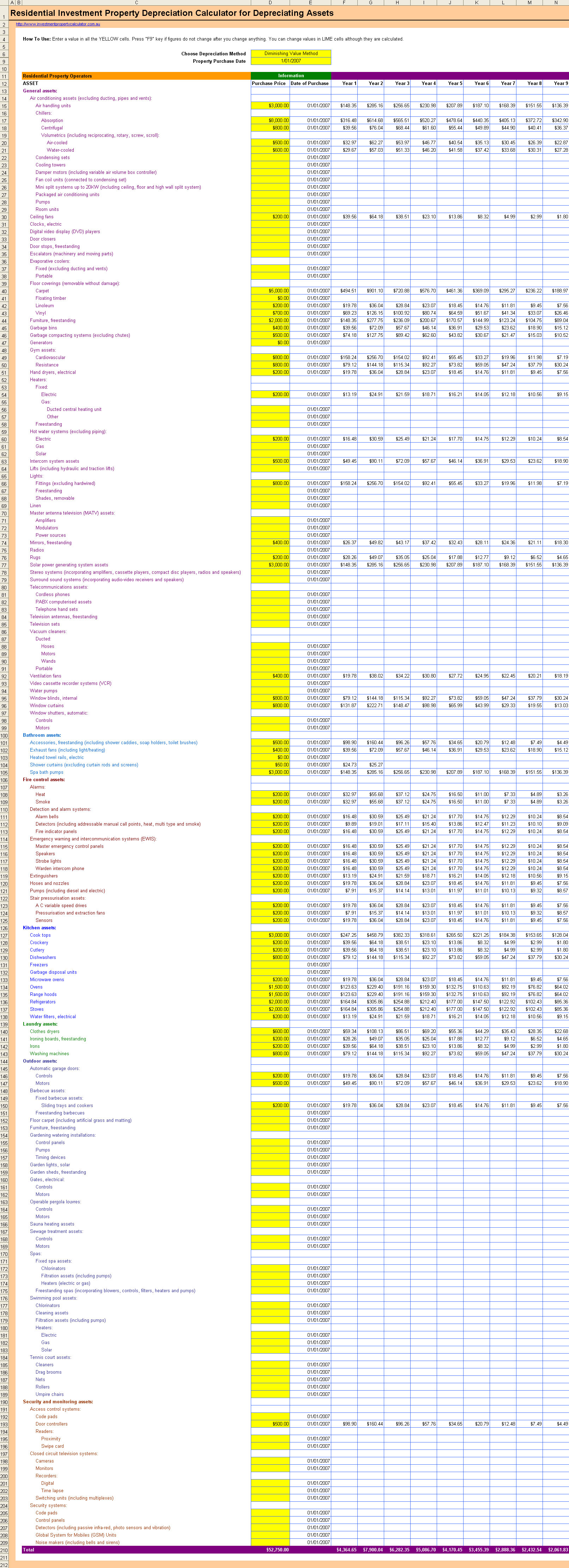

Add Some Real Estate to Your Portfolio. How Rental Property Depreciation Works. You can put all of your assets that have different purchasing dates and usage period within one table.

Income data in this section of the spreadsheet is used to calculate return on investment ROI metrics including net operating income NOI and cash-on-cash return. Section 179 deduction dollar limits. Is considered the year that the property would be sold.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Free rental property Income calculator that I used to model hundreds of deals and build a 15 million-dollar portfolio with great cash flow. Auto expenses to travel to and from your rental property are fully deductible based on actual expenses such as gasoline and repairs or the standard mileage rate of 56 cents per mile.

While not technically income a penny saved is a penny earned. A rental property spreadsheet can be designed to track rental income on a monthly and annual basis. Im looking to buy another cash flowing rental property in 3-5 months when I have enough for a down payment.

This rent property spreadsheet template is free and simple to use. Next set up your rental property analysis spreadsheet by following these four steps. Cash on Cash Return Calculation.

When you sell a rental property you need to pay tax on the profit or gain that you realize. The IRS taxes the profit you made selling your rental property 2 different ways. This means that your rental propertys rate of return is 69.

Including the depreciation you did not deduct. Rental Property Spreadsheets for analyzing rental deals managing rental properties. Depreciation is a term used to describe the reduction in the value of as asset over a number of years.

Fortunately there are several ways to minimize and even avoid paying tax when you sell a rental property. You can add and adjust for additional staff and known costs and then the worksheet calculates the total. Even though there may be additional tax benefits such as depreciation and deduction of.

Cost Accumulated Depreciation on Assets. So if you did not depreciate in past years you can still amend the last 3 years tax returns 2018 2017 and 2016 to claim that depreciation. 275k purchase price 20 down 0 into updating as it is fully updated and rent total is 2925.

Author Real Estate Investor with. Selling costs pay back depreciation capital gains etc. The gross rent multiplier GRM approach values a rental property based on the amount of rent an investor can collect each year.

As an example the following property that the agent told me has an offer is the following per my spreadsheet and info. Tax rate on rental profit if any. Ownership Costs such as those incurred when searching and inspecting for properties.

Something like rental property depreciation can save investors thousands of dollars over the life of a property. There is a formula to calculate depreciation of your company assets automatically. Compatible w Microsoft Excel Google Sheets.

Create a rental property analysis spreadsheet using Microsoft Excel or Google Sheetsdepending on what you are comfortable withand prepare to start your. Enter your email address for free access to the same spreadsheet I use and a video explaining a step by step walk-though of how to model rental property. The Best Real Estate Crowdfunding Sites of 2022.

The difficulty however is keeping track of depreciation since some improvements have varying. A Depreciation Schedule is a table that shows the depreciation amount over the span of the assets life. Download your Free Rental Spreadsheet to Analyze Rental Deals.

Follow these 8 tips to increase your chances of successful rental property investment. Its a good idea to use different techniques. For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000.

Residential Rental Property Depreciation Calculation Depreciation Guru

Best Rental Property Spreadsheet Template For Download Monday Com Blog

Free Macrs Depreciation Calculator For Excel

How To Depreciate A Rental Property Formula Excel Example Zilculator Real Estate Analysis Marketing

Get Organized A Free Rental Property Excel Spreadsheet

Rental Property Management Spreadsheet Template Rental Property Management Rental Property Property Management

Free Modified Accelerated Cost Recovery System Macrs Depreciation

Free Investment Property Depreciation Calculator

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Depreciation Schedule Template For Straight Line And Declining Balance

Residential Rental Property Depreciation Calculation Depreciation Guru

Landlord Template Demo Track Rental Property In Excel Youtube

Rental Property Depreciation Rules Schedule Recapture

How To Fill Out Schedule E Rental Property On Your Tax Return Youtube

I Put Together A Spreadsheet For Evaluating Rental Properties Would Love Some Feedback R Realestateinvesting

Rental Income And Expense Worksheet Propertymanagement Com

Rental Property Depreciation Rules Schedule Recapture